File Income Tax Return Online for Free: Step by Step Guide

Not using the Income Tax Return Online option yet? It is not that tough as you imagine, and if you can spend 30 minutes on the below document, it may help you save Rs.200-400, which you spend as fees for Income Tax Returns towards CAs or commercial websites.

Income Tax Return Online

The Income Tax Department is allowing users the direct e-filing option from their official website and the below steps are based on https://incometaxindiaefiling.gov.in

Preliminary Steps:

1. Create a User Account in https://incometaxindiaefiling.gov.in

2. Login using the same username.

Step by Step Guide for Free Filing of Income Tax Return:

1. View Tax Credit Statement (Form 26A S):Check My Account Tab-Drop Down Menu.

This step will take you to an external website, where you can see your tax-credit. Once verified the details, close this window and log back to your user page in incometaxindiaefiling.gov.in website.

2. Find the ITR Excel Sheet:Download the Excel or PDF utility for ITR

You need a software to fill your income details, and that software will be either an excel file or pdf. Download that file.

3. Download ITR Excel Sheet-Make sure you download the right ITR based upon your profile.

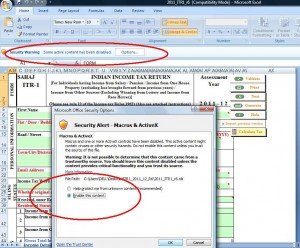

4. Enable Macros and ActiveX

HOW TO ENABLE MACROS IN MICROSOFT EXCEL FOR RETURN PREPARATION UTILITY

It is necessary to ENABLE the execution of macros in Return-Preparation-Utility in order to enter, validate and generate an .XML file for upload. Follow these steps to ENABLE execution of macros depending on the version of [Microsoft Office Excel] being used to open the Return-Preparation-Utility :

[Microsoft Office Excel 2003]

Navigate through the following excel menu option to reduce the level of security in executing macros :

Tools –> Macros –> Security –> Low OR

Tools –> Macros –> Security –> Medium

Save the excel-utility and re-open it.

[Microsoft Office Excel 2007]

Navigate through the following excel menu options to reduce the level of security in executing macros :

Excel Options –> Trust Centre –> Trust Centre Settings –> Macro Settings –> Enable all macros AND Excel Options –> Trust Centre –> Trust Centre Settings –> ActiveX Settings –> Enable all controls without restriction and without prompting. Save the excel-utility and re-open it.

[Microsoft Office Excel 2010]

When you open the EXCEL-UTILITY, the yellow Message Bar appears with a shield icon and the Enable Content button. Click on the Enable Content to enable the macros.

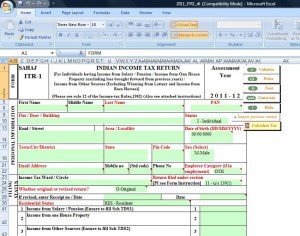

5. Fill details in ITR form:Fill the details, Validate it and Click on Calculate the Tax button.

Make sure you fill details in all sheets of the the excel like Income Tax Details, TDS, Tax paid and verification etc.

6. Submit Return-XML:Generate the XML of ITR and upload it.

7. Successful Completion:Upon successful completion, download ITR-V,sign it and send it to Bangalore address.

Related Links:

http://i-n-d-i-a-n.com/how-to-know-your-income-tax-ward-or-circle/

http://i-n-d-i-a-n.com/how-to-file-income-tax-return-online/

http://i-n-d-i-a-n.com/how-to-file-income-tax-return/

http://i-n-d-i-a-n.com/pay-tax-online/

Disclaimer: These are just guidelines for Income Tax Return filing with the intention of helping users for fast and free e-filing.We are not responsible for any discrepancies or difficulties users face during the process.Kindly check with IT department if you face any problems.

All the best!

Like INDIAN on FB for similar updates in your FB wall : https://www.facebook.com/IndianWebsite