Budget 2013 Summary

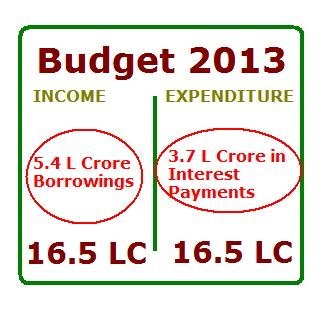

Budget 2013 Summary for a quick glance is given below. Finance minister P.Chidambaram presented a budget of 16.6 lakh crore ( L C) this year, which is the biggest budget presented so far.

Total Income (Receipts) = 16.6 L Crore

* To be met by deficit financing (borrowing)

Total Expenditure = 16.6 L Crore

* Includes plan expenditure (33.3%) and non-plan expenditure (66.66%)

How does India government plan to raise Income as per budget 2013?

Where does the money come from? What is the tax revenue split up? See below :

- Revenue Receipts = 10.5 L C ( which includes net tax revenue to center of 8.8 L C + Non tax revenue of 1.7 L C)

- Capital Receipts = 6 L C ( which includes Recoveries of Loans (0.1 L C) + Other Receipts[ read dis- investments (0.55 L C) + Borrowings and other liabilities [read fiscal deficit] (5.4 L C))

How does India government plan to spend as per budget 2013?

Finance minister proposes 16.6 L C to be spend under Revenue expenditure and Capital Expenditure.

- Revenue expenditure of 14.3 L C (including grants given to states for capital expenditure of 1.7 L C).

- Capital expenditure of 2.3 L C

India Government as per budget plan to spend the same 16.6 L C under planned (coupled with 5 year plan) and un-planned expenditure.

- Non-Plan Expenditure of 11 L C (Revenue Expenditure of 9.9 LC which includes Interest Payments of 3.7 L C + Capital Expenditure of 1.1 L C)

- Plan Expenditure of 5.5 L C ( Revenue Expenditure of 4.4 LC + Capital Expenditure of 1.1 L C)

Deficits of India Government as per Budget 2013

- Fiscal Deficit = Borrowings and other liabilities = Total Expenditure – (Revenue Reciepts + Recoveries of loans + Other reciepts) = 5.4 L C which is 4.8 % of GDP

- Revenue Deficit = Revenue Expenditure – Revenue Receipts = 3.8 L C which is 3.3% of GDP

- Effective Revenue Deficit = Revenue Deficit – Grants given to states for capital creation = 2 L C which is 1.8% of GDP

- Primary Deficit = Fiscal Deficit – Interest Payments = 1.7 LC which is 1.5 % of GDP